Back to disabilitydenials.com

If you become disabled and can no longer work, disability insurance plans and government disability programs offer potential sources of replacement income in the form of disability benefit payments.

These sources of income can become a lifeline for you and your family should the unthinkable happen.

The Complete Guide to Disability Claims, Insurance and Benefits is your one-stop source for disability benefit information. Our easy-to-read guide explains:

- who is eligible for disability benefits

- what type of benefits are available to you

- how to apply for disability benefits

- how to make sure your disability claim is properly prepared

- tips that make the difference between claim approval and claim denial

- what to expect during the disability claims handling process

- how to handle difficult situations that may arise

- what to expect once benefits are granted

- why benefits are denied or terminated, and what to do about it

What type of disability claim do you have?

The following benefits may be available to you:

- Short Term Disability (STD) Insurance and Long Term Disability (LTD) Insurance – These are disability insurance plans sold and administered by insurance companies. You may have purchased a long-term or short-term insurance policy through an insurance agent. Or, your employer may sponsor a group disability plan that covers you and other employees.

- Social Security Disability Insurance (SSDI) – SSDI insures disabled workers who have paid into the system through FICA taxes. It is a Federal disability insurance program managed by the Social Security Administration (SSA).

- Supplemental Security Income (SSI) – Also provided by the Social Security Administration, SSI benefits are available to elderly, blind, and disabled people with little or no income or assets.

- Veterans Disability Compensation – A tax-free financial benefit paid to Veterans with disabilities who became sick or injured as a result of active military service (both combat and non-combat related), and for some post-service disabilities. Veterans’ disability benefits are managed by the Department of Veterans Affairs (VA).

Get Started with Your Disability Claim

To learn about your benefits, click on a link below for information that will help you get started with your claim.

- Guide to Short Term Disability (STD) Insurance Claims

- Guide to Long Term Disability (LTD) Insurance Claims

- Guide to Social Security Disability Insurance (SSDI) / Supplemental Security Income (SSI)

- Guide to Veterans Disability Compensation Claims

Disclaimer: The information in this guide is solely informational; it is not intended to add to or replace any advice given by an attorney or qualified non-attorney representative who is familiar with your specific circumstances.

Table of Contents: Short Term Disability

Guide to Short Term Disability (STD) Insurance Claims

Chapter 1: About Short Term Disability Insurance

- Short Term Disability (STD) & Long Term Disability (LTD) Policies Are Often Connected

- Waiting Periods

- A Short Term Disability Claim Will Always Be an “Own Occupation” Claim

- Your STD Claim Will Not Be Offset by Social Security Disability Benefits

Chapter 2: The Initial Application for STD Benefits

Chapter 3: If Your STD Claim Is Denied: Do Not Give Up

Chapter 4: Getting Legal Representation

Chapter 5: Short Term Disability Insurance vs. Family Medical Leave Act (FMLA)

Guide to Short Term Disability (STD) Insurance Claims

Chapter 1: About Short Term Disability Insurance

The purpose of short term disability insurance is to financially protect yourself for a limited period of time while you are unable to work due to illness or injury. STD partially replaces your income until you either return to work or go on long-term disability.

- Employers may purchase short term disability coverage to offer to employees under a group disability benefit plan. Sometimes employees may also contribute to their short term disability premiums.

- Some STD plans are paid for and administered by the employer (and not by an insurance company.)

- You may also purchase short term disability insurance privately from an agent or broker.

The length of the typical STD claim is from 90 days (3 months) to 180 days (6 months). Other policies cover as little as one week and up to 24 months.

STD can pay up to 100 percent of your base salary.

Short Term Disability (STD) & Long Term Disability (LTD) Policies Are Often Connected.

Does your insurance policy cover both STD and LTD? It is important that you know. Read through your entire policy and understand how it is set up.

If you are covered by a plan that offers short term and long term disability coverage, make sure you know how they coordinate. Many insurance plans are structured so that a claim for short term disability insurance is the required first step to filing a long term disability claim.

And although you may have both STD and LTD coverage in your policy, they are separate plans, each covering a separate period of time.

For example, you may have a 3-6 month Short Term Disability policy for which you would submit an application to receive benefits. Suppose, after the STD coverage is used up, your “short term” disability worsens or evolves into a long term disability. You must reapply for the Long Term Disability portion of the plan.

When this is the case, it is critical that you have a clearly defined record of the disability’s onset.

Waiting Periods

Both short term disability and long term disability plans have a waiting period—also called an elimination period or a qualifying period—that must be met before you are eligible for benefits. This is the time span between disability onset and the point at which coverage becomes payable.

STD waiting periods are measured in days, where LTD waiting periods can be months—the time will be specified in your policy. Ideally, the STD policy matches the length of the LTD waiting period to avoid a lapse in coverage.

A Short Term Disability Claim Will Always Be an “Own Occupation” Claim

STD policies are written to award financial benefits if your disability leaves you unable to do the substantial duties of your own occupation. In other words, you are disabled from performing your usual job tasks (as opposed to just any task.)

For example, if you work in construction and your disability limits your ability to hammer or climb a ladder, you would likely be awarded STD benefits under the policy.

The distinction between “own occupation” and “any occupation” becomes very critical in the event you need to apply for long term disability benefits, after your short term benefits are exhausted.

Read more about Own Occupation vs. Any Occupation in a long term disability claim.

Your STD Claim Will Not Be Offset by Social Security Disability Benefits

The Social Security Disability Insurance (SSDI) program pays benefits only for long term and permanent disabilities. Since your short term disability claim will generally last no more than 3-6 months, those benefits will not be offset by SSDI payments. SSDI is not a short term solution for disability situations.

Learn about Social Security Disability offsets and how they can affect an award of long term disability benefits.

Chapter 2: The Initial Application for STD Benefits

Group Disability Claim: If your coverage is under a group plan through your employer, request the claim forms from your Human Resources department.

Private Disability Claim: If coverage is under your own private plan, also referred to as an Individual Disability Insurance (IDI) plan, contact your insurance provider for the disability claim forms.

Filing the Short Term Disability Claim

The Application Process

Each insurance provider will have its own specific claim submission information that you must follow—whether a claim is filled out and submitted online, by mail on specific forms, or over the telephone.

The claims filing process is basically the same for both short term and long term disability claims, and in many policies the STD claim is just the prerequisite first step to filing the LTD claim.

For detailed information about the filing process, please see:

The Initial Application: How to File a Long Term Disability Claim

What to expect on the claim forms:

Generally the paperwork includes (but is not limited to):

- Claimant’s Statement

- Employer’s Statement

- Attending Physician’s Statement (also referred to as a Physician’s Statement of Disability, or Physician’s Certificate for Disability Benefits)

- Authorization to Obtain and Disclose Information

You will need to have your doctor complete the insurance company’s Attending Physicians Statement form. In addition, the insurance adjuster will need all medical records and supporting documentation pertaining to your condition. Also to be sent is the list of all medical providers who treat you for the disability.

Do not rely on the insurance provider to gather your medical records. It is your responsibility to assemble and forward all medical and vocational evidence to support your claim of disability to the insurer. This includes medical records, doctors’ opinions and evaluations, functional capacity evaluations and other important materials to prove you are unable to work.

The insurance company will review your information and investigate your case to make a determination resulting in the approval, denial, or request for additional information.

If your claim is approved, you will receive benefit payments from the insurance company, a third party administrator, or your employer, depending on the insurance plan arrangement.

If your claim is denied, you will generally be notified in writing.

Tips for a Successful Application

Claimants rarely expect the countless difficulties that emerge as they submit their claims and wait for their benefits. Many initial claims are challenged or denied by the insurers.

It is important to take every possible action to ensure your case is rock-solid and well-founded. The following link will ensure you leave nothing to chance:

20 Tips to Help You Win Benefits on Your Initial Application

Chapter 3: If Your STD Claim Is Denied: Do Not Give Up

As a whole, initial claims for short term disability benefits are more likely to be approved than those for long-term disability insurance. Still, STD claim denials are not uncommon.

STD claims that evolve into LTD claims become much more expensive for the insurer to pay out. Valid claims for short term disability benefits are sometimes denied—or benefits are discontinued—in order for insurance providers to avoid extensive long-term payments.

By denying short term benefits, the insurer effectively reduces your eligibility for long term benefits, paving the way for LTD claim denial.

If your short term disability claim is denied, do not give up or think the process is over. Insurance policies must allow you the opportunity to appeal, or contest, an unfavorable decision.

File an Appeal

While the appeals process is more or less the same across insurance companies, each insurer and policy will have its own unique procedures and timelines. And because policy language rules, you need to review the wording in your policy – plus the information sent in your denial letter – to understand what your responsibilities are for filing an appeal properly and timely.

The time in which you have to file an appeal can be as short as 45 to 60 days, sometimes longer, depending on the policy.

An appeal is much more than filling out more paperwork. The letter of denial will include the reason the insurer denied the claim. Your appeal should be based largely upon the reason your claim was denied.

On appeal, you need to supplement your case with further supporting medical evidence, physician’s opinions, medical expert testimony, as well as corroborative statements from co-workers, family and friends regarding their observations of your disabling condition.

If the information and forms you need to appeal are not sent to you with the denial letter, contact the insurance provider to request they immediately send the necessary information to you.

While you can file an appeal on your own, enlisting the help of a disability insurance lawyer can greatly improve your chances of a getting a fair award of benefits.

Chapter 4: Getting Legal Representation

Initially, claimants are not skeptical of the insurance industry or the disability insurance process. Once their claim is denied, they are at a loss about what to do to get their badly needed insurance coverage.

When it comes to filing a successful appeal, experienced legal counsel is in order. A disability insurance lawyer can take the burden of proof off your shoulders, develop your case properly and apply the law to your benefit, and provide all of the necessary evidence to effectively appeal a wrongly denied insurance claim.

Learn more about getting legal assistance.

Chapter 5: Short Term Disability Insurance vs. Family Medical Leave Act (FMLA)

Both STD and Family Medical Leave are in place to help you if you become disabled and cannot work for a temporary time span. However, they are very different sources with different purposes. It is important not to confuse the two.

Family Medical Leave Protects Your Job

FMLA does not compensate for lost wages. If is a federal program that prevents employers from firing employees who miss weeks or months of work, because they are injured or very sick.

You may be eligible for up to 12 workweeks of leave per year under FMLA. The leave is unpaid: your employer is not required by law to pay you for missed time.

FMLA rules apply in all 50 states, and generally affect companies with 50 or more employees. FMLA also helps you be away from work due to a family member’s medical emergencies, and for maternity leave and adoption.

Short Term Disability Insurance Replaces Income

STD is a disability insurance plan that is totally financial in nature. It does not affect job security; i.e., your employer is not required to hold your job. The insurance carrier that provides the coverage promises to pay on a legitimate disability claim, per policy limits. STD generally starts after any paid sick days are used up, and other policy conditions are met.

Whether purchased privately or provided by an employer, STD coverage is optional. STD only covers the named insured on the policy, and no other family members.

FMLA and STD often work together. Visit the Department of Labor website to learn if you qualify for FMLA.

Table of Contents: Long Term Disability

Guide to Long Term Disability (LTD) Insurance Claims

Chapter 1: About Long Term Disability Insurance

Chapter 2: Types of Disability Insurance Policies

Chapter 3: Group Disability Claims Are Regulated by Federal ERISA Law

Chapter 4: Individual Disability Claims (Non-ERISA) Are Regulated by State Insurance Law

Filing a Claim:

Chapter 5: The Initial Application: How to File a Long Term Disability Claim

Chapter 6: 20 Tips to Help You Win Disability Benefits on Your Initial Application

Chapter 7: How Will Your Long Term Disability Benefits Be Paid?

Chapter 8: Is Your LTD Policy Subject to Exclusions and Limitations?

Chapter 9: What You Must Prove to Win Your Disability Insurance Claim

Chapter 10: RFC – Developing Your Residual Functional Capacity to Prove your Claim

Chapter 11: Why You Need to Appoint Your Own SSD Attorney Representative

Chapter 12: Attorney Representation in a Disability Claim

If Your Claim Is Denied:

Chapter 13: Disability Claim Denied? File an Administrative Appeal

Chapter 14: Legal Representation for Administrative Appeals

Chapter 15: Insurer’s Tactics and Claim Denial

If Your Administrative Appeal Is Denied:

Chapter 16: File an ERISA Lawsuit

Chapter 17: File a Lawsuit on an Individual (Non-ERISA) Disability Insurance Claim

Chapter 18: Legal Representation during Your Lawsuit

Chapter 19: How Does an Attorney Get Paid?

Chapter 20: Getting Legal Representation: What to Look For

Guide to Long-Term Disability (LTD) Insurance Claims

Chapter 1: About Long Term Disability Insurance

The onset of disability can rob you of your ability to work and make a living. Disability insurance policies protect employees and working individuals from the loss of income in the event they become disabled due to illness, injury or other serious impairment.

Insurance companies provide various forms of disability coverage ranging from group workplace benefits to customized, individual benefits, each with varying definitions of “disability” and levels of coverage.

Examples of some of the largest companies that provide disability insurance include Hartford Life, Unum, CIGNA, MetLife, The Standard, Lincoln Financial, Prudential, Aetna, Dearborn National, Liberty Mutual, Provident Life and Paul Revere Insurance.

Chapter 2: Types of Disability Insurance Policies

Disability policies are separated into two main forms regarding duration of coverage: Short Term and Long Term disability coverage.

Policies are also classified into two main types regarding which laws regulate the policy. These two types include group (employer-based) plans and individual (personal) disability policies.

As explained below, the laws governing each are quite different, and will affect your claim in a big way.

Short Term Disability (STD)

Short Term Disability insurance helps replace lost wages if a disability keeps you out of work for a limited time. STD claims are often the prerequisite first step in the long term disability insurance claims process. Short term policies typically cover from 80 to 100% of your salary.

For more information visit our Guide to Short Term Disability claims.

Long Term Disability (LTD)

The purpose of long term disability insurance is to replace a portion of your income when you are unable to work for an extended period of time, or permanently, due to a severely disabling condition or impairment.

LTD policies typically cover about 60–65% of your salary. The cost of long-term disability insurance varies between group plans offered by employers and individual plans, which tend to be more expensive.

Most long term disability policies have a waiting, or qualifying period. This means that before you can apply for LTD benefits, you first must

- apply for and receive all of the short term disability benefits available under the insurance carrier’s policy, or

- satisfy a waiting period by being disabled for up to six months.

LTD benefits are generally paid for 24 months if you become unable to work at your own job. This is referred to as the Own Occupation period.

After the 24-month “own occupation” period, you can potentially receive LTD benefits until age 65, if you continue to prove that you are disabled from doing any job in light of your age, education and training available to you in your area. This becomes the Any Occupation period and, as explained further in this guide, is harder to prove.

Group Disability Plans (Provided by Your Employer)

Long term disability insurance may be sponsored by or offered through your workplace as part of a group disability plan. The laws that govern most group policies are federal laws known by the acronym “ERISA” – The Employee Retirement Income Security Act.

When you file a group disability claim and ERISA laws take over, your claim is suddenly subjected to very strict, complicated federal laws. If your claim is denied, you must follow rigid legal procedures and obey strict deadlines as you appeal your case.

Individual Disability Insurance Plans (Buying Coverage on Your Own)

Coverage purchased on your own behalf is referred to as individual disability insurance (IDI) or privately purchased disability insurance. Many professionals in specialty or high-end occupations such as doctors, dentists, lawyers, CEOs and others buy IDI as a form of income replacement should they become disabled by illness or injury.

Individual coverage is underwritten for you specifically. It is not part of an employer’s group insurance plan. However, individual policies are sometimes used to supplement an employee’s group disability policy.

Individual policies are regulated under state insurance laws regarding bad faith and contract law. These laws are designed to protect the insured and beneficiaries from unfair practices by insurers.

Insurance Riders and Occupation-Specific Policies

A rider is a provision for optional benefits added to the basic policy at additional cost. Individual disability insurance policies are often customized with specific features and supplemented by riders.

By drafting very individualized and occupation-specific policies, a person is able to protect the income level that he or she has worked to achieve over many years. Of course this increases the premiums considerably.

For example,

- Own-Occupation: occupation-specific coverage that states the definition of disability is your specific occupation or sub-specialty rather than the broader definition of “other occupation” or “any occupation.” Example: your occupation is defined as “orthopedic surgeon” instead of “practicing medicine.”

- No limitations or exclusions of coverage concerning disabilities due to mental disorders

- Portability – Your policy travels with you from one job to the next.

- Partial disability benefit riders allow benefits under certain conditions if you are unable to do some or all of the duties of your own occupation full time.

- Cost of living riders allow for increased benefits due to inflation

- Lifetime extension riders allow options for lifetime benefits beyond a certain age

- A Residual Disability Rider will pay if you cannot return to work full time. It can also pay in the event your income is not completely restored. For example, you are a dentist and you go back to work on a full time basis. However, your dental practice has endured financial hardship because of your absence. Residual disability payments (a percentage of the full disability benefit) would help cover this loss as it is a result of your disability.

As you can see, there is a big difference between group and individual plans. If you are denied long term disability benefits under either type of plan, you have the right to appeal the denial.

The remedies that are available to you as a claimant appealing a denied a group policy claim are very different than if your claim is under an individual policy.

The next section explains these differences in detail, so you can better prepare for all communications and dealings with the insurance provider.

Chapter 3: Group Disability Claims Are Regulated by Federal ERISA Law

What Is ERISA?

ERISA stands for the Employee Retirement Income Security Act of 1974. It is a federal law that controls the management of Employee Benefit Plans and the compensation and remedies of the beneficiaries of these Plans.

Practically all long-term disability plans offered by a private employer are governed by ERISA.

If you are challenging a denied disability claim under an ERISA governed plan or policy, you must adhere to ERISA regulations and procedures. That means you must appeal the denial to the same insurance company that denied the claim.

Since ERISA claims are based on federal law, the law and procedures are generally the same in all 50 states. All state law remedies are preempted, meaning they do not apply to an ERISA claim.

ERISA Does Not Apply to Privately Purchased Insurance

If you bought individual or family disability coverage on your own (not through an employer) then ERISA does not apply. Privately purchased disability coverage falls under state contract and insurance laws.

h3 id=”h-other-disability-plans-not-covered-by-erisa”>Other Disability Plans Not Covered by ERISA

- Government employees: Government plans are excluded from ERISA coverage. This generally includes federal, state and local governments including school districts and public universities.

- Church Plans: Employees of qualifying religious institutions such as a church, synagogue or mosque are generally exempt from ERISA.

- Self-Employed Individuals: Self-employed individuals are not governed by ERISA if only the individual and their family are covered.

- Some Partnerships: Similarly, partners in a partnership with a plan that only covers partners, but no employees is not an ERISA governed plan.

- Pass Through Plans: Voluntary Plans where the employer contributed nothing to the plan and merely acted as a “pass-through” are exempted from ERISA if all requirements are met. These are extremely rare as the LTD carriers generally require employer contributions to set up the plan for the express purpose of receiving ERISA protection.

Protections You Lose under ERISA Laws

The following explains what protections you lose under most group disability plans, in the case of a claim denial or dispute.

- ERISA Offers No State Protections: You cannot sue for:

- Emotional distress

- Consequential (or special) damages

- Loss of credit claims

- Prejudgment interest for breach of contract

- Tortious interference with contract

- Statutory insurance violation claims

- Deceptive trade acts or unfair practices

- Bad faith

- Punitive damages

- Mandatory attorney fee reimbursement

- Your Remedies Are Severely Limited Under ERISA. If the insurer unfairly denies your claim, you can only sue for what the insurer should have paid you in the first place. That means the most the insurer will have to pay is the original claim amount and nothing else. With no penalty to deter an insurance company from wrongly denying a valid claim, many claims under group plans are denied.

- No Right to Jury Trial: A jury will not decide your claim. Group disability insurance carriers know they don’t have to worry that a jury of your peers will hold them accountable.

- No Treating Physician Rule: ERISA laws allow the insurance carrier to disregard your treating doctor’s opinions and rely on their own doctor’s opinions if they so choose.

- Little Government Regulation: ERISA law offers little direction as to how an insurance policy should be written. This leaves disability insurance underwriters free to write the policy as they wish. Thus many provisions and clauses are not favorable to the claimant. Often the only incentive to offer favorable provisions is competition from other disability insurance providers.

- You Must Prove the Insurer “Abused Its Discretion”: In a disability insurance claim brought under state law, you only have to prove it is “more likely than not” that you are disabled. Not so for claims brought under ERISA. There, the burden is on you to prove that the insurer “Abused Its Discretion” by denying your claim. You must prove that the insurer had “No Reasonable Basis” for its decision. Insurance companies will rely on their own “independent” exam or review by their own doctors and experts — in order to have some evidence to show that its decision was reasonable.

Chapter 4: Individual Disability Claims (Non-ERISA) Are Regulated by State Insurance Law

Private LTD policies are contracts between you and the insurance provider. Claim disputes under these policies are governed by state contract and bad faith law. If an insurer denies your claim, you can appeal the decision. However, these appeals are often nothing more than an internal review with the same insurer that initially denied the claim.

When an acceptable settlement with an insurance company cannot be reached, bad faith insurance claim litigation becomes necessary. Litigation of private policies are held in state or federal court. The burden of proof is the same as a civil trial. You are allowed a jury trial, and may fully engage in evidence and discovery.

State Protections Available

Depending on the state, the protections and damages that are available to you in a dispute over a private disability claim include:

- Emotional distress

- Consequential (or special) damages

- Loss of credit claims

- Prejudgment interest for breach of contract

- Tortious interference with contract

- Statutory insurance violation claims

- Deceptive trade acts or unfair practices

- Bad faith

- Punitive damages

- Mandatory attorney fee reimbursement

Filing a Claim:

Chapter 5: The Initial Application: How to File a Long Term Disability Claim

Caution: A Successful Claim Requires Building a Strong Case

The initial application process for long term disability benefits may seem as simple as filling out the forms sent by your insurer. Yet this is never the case.

A great amount of preparation and forethought is required on the claimant’s end to prepare a claim that does not end up delayed or denied.

There are many pieces of evidence you will need to collect, complete and submit. Numerous bits of information must be carefully worded and supported to build an ironclad case.

The remainder of this guide is designed to inform disability claimants how to put together and present a strong claim of disability to their insurance provider.

A qualified attorney can be a true asset in properly submitting a disability claim. He or she will work with your doctors and various medical experts to produce essential evidence, as well as anticipate the tactics insurers may resort to in efforts to deny paying a claim.

Consider consulting an attorney who has reviewed or appealed hundreds of LTD claims. A good lawyer will develop your case so that it is strong enough to prevent a denial based on allegations that you are not disabled under the terms of the policy, or for insufficient or partial information.

Learn more about getting legal assistance.

The Application Process

For both STD and LTD claims, all insurance companies have their standard packet of forms to be completed, but that is where the similarity ends. Each company’s paperwork is uniquely worded in critical ways.

For a group / ERISA policy, claim forms and filing information will be available to the claimant from the Human Resources department of the employer.

For a privately purchased policy, claim forms and filing information will be available to the policyholder directly from the insurance provider.

Your insurer will have submission information that you must follow—whether a claim is filled out and submitted online, by mail on specific paper copy forms, by fax or over the telephone.

What can you expect on the claim forms? Generally the paperwork includes (but is not limited to):

- Claimant’s Statement – You complete this form with your personal information, employment information, information about your claimed disability, your care and treatment (including a complete listing and contact information for all doctors, pharmacies and hospitals who treat you for the disability), other sources of income and benefits you have received or are receiving, and tax withholding information.

- Employer’s Statement (for group claims) – Your employer completes this form with information about the employer, about you as an employee, about your job, your insurability, withholding and reporting taxes, your pension plan, physical aspects of your job, last day worked, your reason for leaving work, job accommodation or return-to-work policies and salary.

- Attending Physician’s Statement – Medical information to be completed by your treating doctor should include the details of diagnosis, treatment, level of functional impairment (physical and psychiatric), and return to work expectation. Your doctor is requested to attach and send all medical records and supporting documentation relevant to your impairment.

- Authorization to Obtain and Disclose Information – This form grants the Insurance Company permission to obtain any information about you from any medical, pharmacy, business, insurance, financial, governmental or other organization or person with knowledge of you or your health.

You compile and review all of the above forms, statements and records, and submit them to the insurance company to review.

The Review Process

Do not assume the insurer help you gather your medical records from the providers. It is your responsibility to see that all medical and vocational evidence is collected and delivered to support your claim of disability to the insurer. This includes medical records, doctors’ opinions and evaluations, functional capacity exams and other relevant information to show you are unable to work.

The insurer will review and investigate your case and reach a decision to approve, deny or request more information.

NOTE: Claimants rarely expect difficulties to emerge as they submit their claims and wait for their benefits. The reality is, many initial claims are wrongfully challenged or denied by the insurers.

If your claim is approved, you will receive benefit payments from the insurance company or a third party administrator, depending on the insurance plan arrangement.

If your claim is denied, you will generally be notified in writing. You have the right to appeal the denial.

Go here for details on appealing a denied LTD claim.

It is important to take every possible action to ensure your case is rock-solid and well-founded. The following tips will ensure you leave nothing to chance; these tips are further explained throughout this guide.

Chapter 6: 20 Tips to Help You Win Disability Benefits on Your Initial Application

The following steps will help ensure that you do not leave anything to chance when filling out and submitting your initial application for a short term or long term disability claim.

1. Read Your Policy!

Read through your policy to know how your benefits are structured. If you do not have a copy, ask your employer or the insurance company for a copy. The exact terms and language in your disability policy is unique to you, and that language is what governs how benefits may be awarded or denied. Know the type of policy you have. Know how your policy defines “disability.”

2. Review the Claim Form.

Become familiar with the information you need to provide the insurance company before filling out the form.

The claim form will generally have:

- Employee or Claimant Statement

- Employer’s Statement (for group claims)

- Attending Physician’s Statement (also called a Physician’s Statement of Disability, or Physician’s Certificate for Disability Benefits)

- Authorization to Obtain and Disclose Information

Read and become familiar with all sections to know exactly what is expected of you, your employer and your physician. The claim forms typically do not allow room for the level of detail that a well-developed claim needs to present. Use additional paper so you can be as thorough as possible to explain the particulars of every aspect of your claim to the insurance adjuster.

There will be critical time limits you must follow. Make sure to read and understand the deadlines and cutoff dates required by the disability policy and the claim form.

3. Understand the Connection between Your STD and LTD Policies

Check to see whether your disability plan is set up where the short term and long term policies interact. Most long term policies often require that you exhaust all short term benefits in order to meet the elimination (waiting) period that is required before long term disability benefits will be paid.

For instance, your policy might have a 3-6 month short term disability policy for which you must initially submit an application. Once this STD coverage is exhausted, you would need to reapply for the long term disability portion of the plan. Denial of a short term claim will prevent the approval of a long term disability claim.

4. Understand your policy’s structure.

The initial term of most LTD plans, usually 24 months, is referred to as the “Own Occupation” portion of the plan. After that 24-month term has expired, to continue benefits you must meet the tougher “Any Occupation” definition of disability to continue to receive benefits. You need to develop a case with evidence that will stand up to this shifting definition of disability.

Know if your policy allows you to age out of coverage. Most policies naturally terminate at the claimant’s retirement age, either age 65 or the full Social Security Retirement Age for the individual claimant.

5. Know what medical conditions may be excluded or limited.

Check your policy to learn of any impairments that may have limited benefits. If is common for disability policies to restrict or exclude benefit payments for certain disorders.

For example, does your policy have limitations for

- impairments based on self-reported symptoms such as chronic fatigue

- soft tissue injuries not supported by objective medical evidence

- Pre-existing conditions

- Mental or psychological disorders

You can increase your chances of receiving a favorable decision by concentrating on medical conditions and functional limitations that are not subject to limitations, exclusions or preexisting limitation exclusions written into your policy.

6. Talk with Your Doctor about Your Decision to Apply for Disability Benefits.

Your doctor is your ally. Review your medical records with him or her. As the claimant, the burden is on you to submit to the insurance company sufficient medical evidence that you are too impaired to continue working at your current job.

This should include

- comprehensive medical documentation of your diagnosed condition

- your doctors’ assessment of your functional limitations resulting from your disability

- meeting all required deadlines

Reach agreement with your doctor about presenting your case in the best possible way. Prepare your doctor for the likelihood of being interviewed by the insurance company, and receiving follow-up forms from the insurer.

7. Alert Your Doctors to Expect Phone Calls from Insurance Company Doctors.

Help prepare your doctors for the demands the insurance company is about to make. These requests may include asking your doctor to complete and submit monthly disability forms. One missed form can lead to claim denial. The insurer will also call your doctor to discuss your case directly. Explain to your doctor that he or she needs to take that call.

8. Assume you are under surveillance.

Insurance companies often use covert video surveillance to catch you doing something that you stated in your claim you are disabled from doing. Surveillance might include recording your drives to doctor’s appointments or the grocery store. Insurers may also be watching social media activity. Also, insurers may send their claims investigators to your home without warning to question you about your claim while you are off guard. You have the right to refuse a surprise visit and ask them to reschedule for a more acceptable time for you.

9. Be Ready for Unusual and Difficult Requests by the Insurer

The process of filing a claim and securing disability benefits might be more challenging than expected. One such challenge is that insurers often ask for documents or forms to be filled out and submitted repeatedly. Be prepared and proactive: keep up with and complete relentless requests for the same information.

10. Prepare to file for Social Security Disability Insurance.

Your LTD insurer will require you to file for Social Security Disability benefits within 12 months of disability. The reason is because the insurance provider is allowed to offset (subtract the amount) of your Social Security Disability benefits from the benefits they owe you. You do need to file for SSDI, but be aware if your insurer wants you to use their recommended SSDI representative.

11. Know How Your Disability Policy Defines Your Salary vs. Bonus.

Most policies base monthly benefits on your base salary and leave out bonuses or commissions. But every policy is different. Find out if your policy factors in other forms of compensation such as bonuses and commissions and how these forms of compensation and your salary are defined and calculated.

12. Pick your onset of disability date.

You will need to state the date that you became disabled. Your date of disability can affect your claim a couple of ways: (1) if there is a question of a preexisting exclusion, or other certain limitations and exclusions in the policy; (2) the onset of disability date must be alleged to be during a period where insurance coverage is in effect.

If it is possible to time your claim for disability, it is best to have an experienced attorney look at these issues before you make your disability claim.

13. Compare Your Job Description to Your Employer’s Description of Your Job

The first 24 months of LTD benefits will be based on an “own occupation” definition of disability. So it is important that your job description captures what you really do.

Write down what your actual job entails. Include your physical, mental and travel requirements—job duties that you perform routinely. Examine your description in contrast to your employer’s version of what you do.

Do the two match? It is vital to the success of your short term or long term disability claim that your physician’s description of your functional limitations clearly demonstrates—when viewed alongside your true job description— that you can no longer do that job.

14. Work on a Draft Copy of the Application – Then Make a Final Copy

Make some copies of the blank application form, and prepare a working copy that you can edit and perfect. Then make a final version on the original claim form that is neat, clean and presents a well-founded, justified claim for disability. Make and keep at least one copy of your final version.

15. Do Not Use Absolute Statements to Describe Your Limitations

When describing your physical limitations, do not use absolutes like “always” and “never.” Statements such as “I can never stand for 30 minutes” or “I always need a walker to get from my bed to the chair” are often easily contradicted by the insurance company. Less definite words like “frequently, sometimes, occasionally or seldom” are less apt to be challenged.

Once an absolute statement is disproved, whether by your own medical documentation or by video surveillance, you are labeled a fraud and the insurance company will have grounds for denial.

16. Watch Out for Unclear or Evasive Questions or Choices in the Application

Some disability insurance applications ask questions that wrongly assume facts that are not true, or offer multiple choice answers that only lead to an unfair conclusion.

For example, a claim form may ask what level of activity you are capable of. You have the following choices: heavy, medium, light or sedentary. The result is that any answer you choose can result in your claim being denied. A fair question would also include the choice “none of the above.”

17. Know the Difference between Total and Partial Disability

Most policies will provide definitions of Total and Partial disability and the requirements of both.

There can be a big difference between total vs. partial disability in terms of collecting disability payments. Partial disability sometimes results in a lower payment because the person may still be able to work, but cannot do the same types of tasks as before.

If you think you may be able to work part time and plan on filing for partial disability, take a close look at the mathematical formulas and limits.

18. Keep a Record of all Medical Providers and Prescriptions.

In the application, include an up-to-date list of your medical providers with verified contact information. If your physicians cannot be reached through the information submitted in the application, they may be treated as if they don’t exist.

Also specify all prescription medications and the side effects of each medication.

19. Follow All Filing and Appeal Deadlines Precisely

You must file your application for disability within specific time periods stated in your policy.

If your short term disability claim is denied, you have a very short timeframe in which to appeal—often as little as 45 days depending on the policy.

If your long term disability claim is denied or your existing benefits are terminated, you typically have 180 days to appeal the denial.

If your appeal is denied, you have a limited amount of time to file your lawsuit that can vary from state to state or could be limited under the terms of the policy.

20. Consult with experienced disability insurance attorneys.

It is wise to consult with an attorney who concentrates in disability insurance law and ERISA law prior to filing your application. It is essential to consult with one before appealing a denied claim.

Chapter 7: How Will Your Long Term Disability Benefits Be Paid?

A Percentage of Your Salary

Most disability policies pay 60% of a claimant’s salary. If you work on a commission or other non-salaried basis, the insurer uses a calculation described in your policy to arrive at a benefit amount.

- Benefits Are Usually Paid Up to Retirement Age: If you can continue to prove ongoing disability, benefits are often paid through age 65, depending on the policy.

- Special Rules if Disability Occurs After Age 60: If your disability begins after age 60, benefits are paid according to a schedule in the policy. Depending on your age, benefits will be paid for a maximum number of months. For example, a claimant who becomes disabled at age 63 would get 36 months; age 64, 30 months.

Partial or Residual Disability Benefit

Some policies allow you to work on a part time basis or carry out lighter job duties if you are disabled from functioning at your full-time level of work. A partial or residual disability benefit is payable if your disability causes your income to drop more than a certain percentage—typically 20% below your regular income.

Your policy will require you to make a certain percentage less than your regular salary. Normally in this case, you would be earning less money than if you worked full time or full duty.

How Social Security Disability Benefits Can Offset LTD Payments

Most policies have a Social Security offset. This means if you get a monthly Social Security Disability (SSD) benefit, the amount of the SSD check is “subtracted” from the monthly LTD check.

For example, you have been getting monthly checks for $2,500 from your long term disability insurance company. Now you start receiving monthly SSD checks in the amount of $1,000. Your insurance provider will reduce their LTD payment from $2,500 to $1,500. You still receive a total of $2,500 a month, but $1,000 from SSD and $1,500 from LTD.

Retroactive SSDI benefits can be deducted from your LTD benefits, meaning you must pay the retroactive award amount back to the insurance provider.

Watch Out for Overpayments

Like most claimants, you might file a claim for Social Security Disability benefits around the same time as you apply for long term disability benefits.

As part of the LTD insurance application, you may notice a form that you must sign telling the insurance company how you will “pay back” the SSD offset. You can choose to have the insurance company estimate how much your SSD benefit will be. The insurer will then “deduct” that estimate from your monthly LTD benefit.

However, most claimants do not take this option. Instead they choose the lump sum option. This pays back the SSD offset in one lump sum to the insurance company, so the claimant can receive their full LTD monthly benefit.

But this option often works against the claimant. For many disabled workers, the SSD backpay can be a substantial sum of money. Figure in that it can take up to two years for a claimant to receive an SSD award. In this case your SSD back benefits can amount to thousands of dollars.

Once you receive the SSD award and back benefits, the insurance company will act to recover the full amount of back benefits. But consider that you have been disabled from working, getting just 60% of your former wages. The reality is that most claimants have already spent their SSD back benefits to pay bills.

If you are unable to pay back the full SSD amount in a lump sum to the insurance company, the company can hold back the entire LTD monthly benefit towards the amount of Social Security Disability offsets that your “owe.”

This problem is made worse when the SSD award arrives just as you reach the “any occupation” definition of disability at 24 months, because the insurance company may cut off benefits when the policy changes, leaving you with a large overpayment to repay.

Read more about the “Any Occupation” definition of disability.

Other Possible Offsets (Deductions)

Offsets may also occur with other types of income, such as worker’s compensation benefits, certain retirement benefits, settlements from lawsuits, and state-provided short term disability benefits.

Sometimes the total of all offsets is greater than the monthly LTD benefit amount. In this case, most policies provide for a minimum monthly payment of $100 or 10% of the monthly LTD benefit.

Chapter 8: Is Your LTD Policy Subject to Exclusions and Limitations?

Make sure your policy covers your condition! No policy covers every condition, and those diseases, injuries and impairments that are not covered, or have limited coverage, may carry great weight regarding your claim’s success.

Get familiar with your policy’s exclusions and limitations. If the language is unclear, ask the insurance company. We describe common examples below; but read your policy carefully to know exactly what you can expect.

Disabilities Caused by Preexisting Conditions

A pre-existing condition is an illness or injury that began or occurred before you were covered under the policy. Most policies “exclude” pre-existing conditions, which means you cannot receive benefits if those illnesses or injuries occurred in the past.

Pre-existing exclusions usually come into effect when a person has been eligible for benefits for less than a year (sometimes this period is two years.) Besides the preexisting condition exclusion time period of a year, there is also a “look back” period, usually the three months prior. This means if you were treated for the claimed condition during the three-months before the effective date of your policy, you are ineligible for benefits.

Basically, if you apply for LTD benefits less than a year after you sign up for the benefit, the insurer will review all your medical and pharmacy records for the entire year plus the look back period, looking for a pre-existing condition.

Pre-existing exclusions are typically very broad. For example, you may have been prescribed a medication for the treatment of anxiety during the look back period. Later, you develop a back problem with muscle spasms, and file a disability claim for that condition.

The same medication that was prescribed to treat your anxiety is now being prescribed to treat muscle spasms. The insurance adjuster will access your pharmacy records and see that you took this medication in the past. The adjuster may stretch the “pre-existing’ interpretation of your claim record and say that you are being treated for muscle spasms because were prescribed this medication in the past. This enables the insurer to deny disability benefits based on the preexisting condition exclusion.

Mental or Nervous Condition Limitation

Most policies have a 24 month mental health limitation. This means that benefits for mental health conditions such as depression, anxiety or bipolar disorder will only be paid for 24 months. This is a common reason for benefits to initially be awarded but cut-off after two years.

Depression as a Secondary Condition

In cases of chronic pain, it is not uncommon for claimants to develop depression as a secondary condition. The insurance adjuster may try to classify depression as a mental impairment, so that benefits will be paid for only 24 months. The adjuster may also try to classify a cognitive problem or side effects from narcotic pain medications as a mental impairment.

Make sure the insurance carrier does not misrepresent your physical disability as mental.

Limited Coverage of Self-Reported Symptoms

LTD policies can limit benefits if certain criteria are not met. Many diseases and injuries can be convincingly demonstrated through “objective medical evidence.” Objective evidence usually refers to diagnostic tests like MRIs, blood work or X-rays.

Many claimants struggle with disabling conditions that cannot be based on such telltale, obvious proof. These conditions are primarily based on self-reported symptoms, as opposed to objective medical evidence.

Some symptoms, like chronic pain, some diseases, like fibromyalgia and chronic fatigue syndrome, and some injuries like soft tissue injuries—do not show up on any “objective” tests. These symptoms and diseases are diagnosed by the doctor based on a history of clinical consultation and observation, patient reports, medical history, exclusionary testing, treatment and prognosis.

h3 id=”h-non-exertional-limitations”>Non-Exertional Limitations

Non-exertional limitations are also mostly self-reported and therefore, mostly disregarded by the insurance provider. Examples of non-exertional limitations include fatigue, headache, intellectual and cognitive limitations (such as concentrating, anxiety, depression), memory loss and medication side effects.

Chapter 9: What You Must Prove to Win Your Disability Insurance Claim

h3 id=”h-your-policy-s-definition-of-disability”>Your Policy’s Definition of Disability

There is no one legal definition of disability. The definition varies among insurance companies and between policies. Definitions applied by the insurance industry differ from the Social Security Administration’s definition and the Dept. of Veterans Affairs’ definition of disability.

You must read your policy to know what the definition of disability is that you must meet. Usually it is roughly similar to, “due to sickness or injury the employee is unable to perform the material and substantial duties of his or her own occupation.”

After 24 months pass, the definition in most LTD policies shifts from “own occupation” to “any occupation,” which is more rigid – meaning you must prove you cannot perform any job for which you are reasonably qualified based on your education, training, or experience.

Not only does the insurance company define disability; the insurer also interprets the terms in their definition and decides whether you are disabled or not. This creates an inherent financial conflict of interest.

h3 id=”h-your-treating-doctor-s-opinion-vs-the-insurance-company-s-in-house-opinion”>Your Treating Doctor’s Opinion vs. the Insurance Company’s In-House Opinion

To determine if you are disabled, the insurance provider relies on their own employees or consultants to review your medical records. The opinions of these in-house nurses or doctors are often different than your own treating doctor’s opinion. Thus the insurer may take the stance that your doctor’s opinion is not supported by the medical records.

In reviewing this type of activity, the Supreme Court has decided that the “treating physician rule” (as used by the Social Security Administration) does not apply in LTD insurance determinations.

According to the treating physician rule, in SSDI claims if your treating doctor says you are disabled, that opinion is given “great weight” towards the decision.

In private and group LTD plans however, the Supreme Court has ruled that your doctor’s opinion that you are disabled should be taken into account as “a factor” in the insurer’s decision to award disability benefits.

h3 id=”h-an-award-of-social-security-disability-does-not-influence-your-insurer-s-decision”>An Award of Social Security Disability Does Not Influence Your Insurer’s Decision

For someone under 50 years old, Social Security’s definition of disability states that he or she must be unable to work at any occupation available in the national economy. This actually is a stiffer requirement than an LTD definition.

And since Social Security has somewhat different standards for disability, the insurance company will ignore an award of benefits by Social Security by stating that the rules are different.

h3 id=”h-but-the-insurance-company-helped-me-get-social-security-disability”>But the Insurance Company Helped Me Get Social Security Disability

If you are approved for LTD benefits, your insurer will help you apply for and receive Social Security Disability benefits. You should know that your award of SSDI benefits helps the insurer financially.

Insurance carriers contract with another company that represents claimants before the SSA. Your insurer will reduce your LTD monthly benefit by the amount Social Security Disability pays you, and will require you to “pay back” the back benefits received from Social Security.

h3 id=”h-proving-the-economics-of-a-long-term-disability-claim”>Proving the Economics of a Long Term Disability Claim

The insurance industry uses various measures to control the cost of paying on individual disability insurance claims, or to award or deny valid claims.

One strategy used to deny claims filed by medical professionals (under their private policy) is to classify a doctor or dentist’s past work as a generalist, rather than a specialist. These practices are largely based on surgical procedures such as endoscopies, eye laser treatments, routine dental surgery or skin biopsies.

For example, an ophthalmologist suffers neurological problems affecting hand dexterity and can no longer perform eye surgery. Suddenly forced to work as a general eye doctor in an office setting, by no means will he or she make the same kind of income as when he or she regularly performed eye surgery.

By classifying a specialist’s past work as a generalist, the insurer protects its profits without taking into account any loss of income for the disabled medical specialist. This is an important tactic to watch out for, and a valid component to demonstrate and prove on your claim for benefits.

h3 id=”h-the-vocational-review-by-the-insurer”>The Vocational Review by the Insurer

If the insurance adjuster finds you to be “not disabled,” he or she may perform what is called a “vocational review.” Using any restrictions the insurance adjuster says that you have, and with the skills derived from your past work history, a vocational analyst will produce a list of jobs that you can perform.

The vocational analyst will state that these occupations are available in your home region and that the job will pay usually, at least 60-80% of your pre-disability earnings. These reviews are often flawed and make unreasonable suggestions for occupations.

h3 id=”h-your-residual-functional-capacity-rfc”>Your Residual Functional Capacity (RFC)

Your RFC – residual functional capacity – is based on the physical level of work you are able to perform as an impaired person. The Dictionary of Occupational Titles and Social Security define work as:

- sedentary

- light

- medium

- heavy

- very heavy

A sedentary job is comparable to an office setting or clerical work: Sitting for up to six hours a day, standing or walking up to two hours a day and lifting and carrying up to 10 pounds, like files or small objects.

A light job requires that you are able to stand or walk up to six hours per day and frequently lift and carry 10 pounds and occasionally lift and carry 20 pounds. Most medical and dental professions and specialties are considered light jobs. Other examples of light job classification might be a cashier or security guard.

A medium job, like a nurse or commercial truck driver, requires the ability to lift 50 pounds;

Heavy work, like construction, requires the ability to lift 100 pounds; and

Very heavy work requires the ability to lift more than 100 pounds.

Proving what your RFC currently is and what may be expected from you in the future can be a critical factor in your disability claim. The following section of this guide will help you better understand your RFC and how to apply it to support your case.

Chapter 10: RFC – Developing Your Residual Functional Capacity to Prove your Claim

Being disabled means you suffer from an impairment and symptoms which result in physical and/or mental limitations. Your RFC is the most you can do despite your limitations.

RFC helps to assess the maximum remaining ability you have to do sustained work tasks in an ordinary job setting on a regular and continuing basis. A regular and continuing basis means work done for eight hours a day, for five days a week, or an equivalent schedule.

Your RFC is expressed in terms of the exertional classifications of work. As mentioned above, these classifications are described as sedentary, light, medium, heavy, or very heavy work.

h3 id=”h-exertional-activities-for-ltd-claims”>Exertional Activities for LTD Claims

Your RFC must be understood in terms of the seven primary strength, or exertional, activities of work. These consist of three work positions and four worker movements of objects, as follows:

Three work positions:

- Sitting

- Standing

- Walking

Four worker movements of objects:

- Lifting

- Carrying

- Pushing

- Pulling

h3 id=”h-definition-of-residual-functional-capacity”>Definition of Residual Functional Capacity

To determine what you can still do regardless of your impairment, the insurance company’s claims analyst should consider all relevant medical and non-medical evidence.

This includes medical records, opinions and assessments by treating doctors, evaluations of the medical evidence by non-examining physicians, as well as your testimony and the testimony of others who have observed you.

h3 id=”h-the-five-rfc-levels”>The Five RFC Levels

Remember the five exertional RFC levels—sedentary, light, medium, heavy, and very heavy.

Each is defined in terms of the degree that the seven primary strength demands of jobs are required: sitting, standing, walking, lifting, carrying, pushing and pulling.

The extent that the seven primary strength demands are required are explained below:

SEDENTARY WORK

- Sitting should generally total approximately six hours of an 8-hour workday.

- Periods of standing or walking should generally total no more than 2 hours of an 8-hour workday.

- Lifting no more than 10 pounds at a time.

- Occasionally lifting or carrying articles like docket files, ledgers and small tools.

- The term “occasionally” means occurring from very little up to one-third of the time.

LIGHT WORK

- Requires standing or walking off and on, for a total of approximately six hours in an 8-hour workday.

- May involve sitting most of the time, but with some pushing and pulling of arm-hand or leg-foot controls which require greater exertion than in sedentary work.

- Lifting no more than 20 pounds at a time.

- Frequent lifting or carrying of objects weighing up to 10 pounds.

- The term “frequent” means occurring from one-third to two-thirds of the time.

- If someone can do light work, he or she also can do sedentary work, unless there are additional limiting factors such as loss of fine dexterity or inability to sit for long periods.

MEDIUM WORK

- Requires standing or walking off and on, for a total of approximately six hours in an 8-hour workday.

- As in light work, sitting may occur intermittently during the remaining time.

- Lifting no more than 50 pounds at a time.

- Frequent lifting or carrying of objects weighing up to 25 pounds.

- The term “frequent” means occurring from one-third to two-thirds of the time.

- If someone can do medium work, he or she also can do light and sedentary work.

HEAVY WORK

- Requires standing or walking off and on, for a total of approximately six hours in an 8-hour workday.

- Lifting objects weighing no more than 100 pounds at a time.

- Frequent lifting or carrying of objects weighing up to 50 pounds.

- If someone can do heavy work, he or she also can do medium, light, and sedentary work.

VERY HEAVY WORK

- Requires standing or walking off and on, for a total of approximately six hours in an 8-hour workday.

- Lifting objects weighing more than 100 pounds at a time.

- Frequent lifting or carrying of objects weighing 50 pounds or more.

- If someone can do very heavy work, SSA determines that he or she also can do heavy, medium, light, and sedentary work.

h3 id=”h-rfc-all-physical-and-mental-impairments-must-be-considered”>RFC: ALL Physical and Mental Impairments Must Be Considered

In evaluating your RFC, the claims examiner should consider all competent medical evidence, and after taking into account all of your impairments, assess the physical and mental activities that you can perform in a work setting.

The claims examiner must consider all symptoms, including pain.

h3 id=”h-rfc-effect-of-mental-impairments-must-be-considered”>RFC: Effect of Mental Impairments Must Be Considered

If you are claiming a mental disorder, the insurance company should determine whether this condition further limits the exertional tasks you are considered capable of doing.

The evaluation of RFC concerning mental disorders includes considering your ability to understand, to carry out and remember instructions and to respond appropriately to supervision, coworkers and customary work pressures in a work setting.

To properly make this assessment, evidence should include:

- History, findings, and observations from medical sources (including psychological test results) regarding the presence, frequency and intensity of hallucinations, delusions or paranoid tendencies; depression or elation; confusion or disorientation; conversion symptoms or phobias; psychophysiological symptoms; withdrawn or bizarre behavior; anxiety or tension.

- Reports of your activities of daily living and work activity, as well as testimony of third parties about your performance and behavior.

- Quality of daily activities, both in occupational and social spheres.

- Your ability to sustain activities, interests and relate to others over a period of time. The frequency, appropriateness and independence of the activities must also be considered.

- Your level of intellectual functioning.

- Your ability to function in a work-like situation.

h3 id=”h-rfc-non-medical-evidence-must-be-considered”>RFC: Non-Medical Evidence Must Be Considered

Non-medical evidence can play a key role in determining the functional limitations of a person suffering from a mental impairment.Suchsources include social workers and family members.

The courts have noted that ‘[i]nformation concerning an individual’s performance in any work setting (including sheltered work and volunteer or competitive work) … may be pertinent in assessing the individual’s ability to function in a competitive work environment.’

Determining RFC may also revolve around subjective reports of pain testified to by the claimant, in addition to and supporting medical facts, diagnoses and medical opinions based on such facts.

h3 id=”h-rfc-effect-of-absenteeism-on-the-ability-to-work-must-be-considered”>RFC: Effect of Absenteeism on the Ability to Work Must Be Considered

It is a good idea to have a vocational expert evaluate your impairment related to excessive absenteeism.

The insurance company should take into account (1) the fact that you would be absent from the workplace an excessive amount of time due to your condition, and (2) the treatment regimen required to treat your condition.

h3 id=”h-rfc-your-skill-level”>RFC: Your Skill Level

Skill levels are also defined by the Dictionary of Occupational Titles, based somewhat on how long it takes a person to learn a skill.

- Unskilled or semi-skilled jobs, rated at skill level 1, 2, or 3, take less than 30 days to learn;

- Skilled jobs are rated at 4, 5 and 6;

- Very skilled jobs are 7, 8 and 9.

h3 id=”h-rfc-own-occupation-standard-first-24-months”>RFC: “Own Occupation” Standard (First 24 Months)

The definition of “own occupation” is found in the insurance policy. Generally the definition is based on how the job is performed in the national economy as defined by the Dictionary of Occupational Titles—not how the claimant actually performs his or her own occupation.

For the first 24 months (or as defined in the policy) you only have to be unable to perform your “own occupation.”

Example A: Nursing falls in the Medium job class. Your occupation is a registered nurse, but because of a severe back impairment you are now restricted to lifting only 10 pounds; therefore, you would not be able to perform your own occupation.

Example B: You are a heart surgeon diagnosed with Parkinson’s disease. You are losing the ability to perform the essential tasks and duties of your own specialty practice. Cardiac surgery falls within the Light job class and is considered skilled work requiring years of training and education. Although you may still be able to lift 20 pounds and stand for 6 hours, tremors, weakness and the loss of fine dexterity must be taken into account as rendering you to be disabled from your own occupation.

h3 id=”h-rfc-any-occupation-standard”>RFC: “Any Occupation” Standard

After 24 months pass, the definition in most LTD policies shifts from “own occupation” to the broader definition of “any occupation.” Because the definition is broader, it is harder to prove. Now you must demonstrate that you cannot work in any job for which you are reasonably qualified based on your education, training, or experience.

h3 id=”h-rfc-salary-percentage-provision-under-any-occupation-standard”>RFC: Salary Percentage Provision under “Any Occupation” Standard

The “any occupation” standard usually includes a salary percentage requirement. This requirement is a provision in your policy stating that your insurance company cannot simply say that you qualify for any job, at any wage—and based on that, deny you disability benefits. Your insurer is obligated to find occupations that will pay you typically at least 80 percent of your pre-disability income.

Chapter 11: Why You Need to Appoint Your Own SSD Attorney Representative

Review your policy to see if it contains language requiring you to apply for Social Security Disability Insurance (SSDI). If it does, this provision also gives the insurance provider the right to offset (subtract) any Social Security benefits from the LTD monthly payment. Your LTD benefits will be reduced by the amount of Social Security disability that you receive.

For instance: If the insurance company is supposed to pay you $3,500 per month, and you also win Social Security Disability that pays you $1,800 per month, the LTD insurance company now only has to pay you $1,700 per month. You will also be required to reimburse the insurance company from the back benefits of any social security disability award.

h3 id=”h-the-insurer-s-motive-for-recommending-their-preferred-social-security-advocate”>The Insurer’s Motive for Recommending Their Preferred Social Security Advocate

The insurance company may urge that you allow their recommended SSDI representative to help you obtain Social Security disability benefits. They will frame this recommendation so that it appears they have your best interest in mind.

In reality, the insurer has a financial motive to help you win Social Security Disability benefits. By putting your SSDI case in the hands of their chosen claims management company, the insurance company can control who represents you before the Social Security Administration.

So the first thing your insurance company does is to solicit you to sign up with their recommended SSD representative to handle your SSD claim. Your insurance provider tells you they will pay the representative, making this is a free service to you. This tactic has you thinking that you are saving money and will be taken care of as far as receiving your SSD benefits.

Their purpose is to collect your back due benefits to reimburse your insurance company. This also gives the insurer a way to keep tabs on your SSDI claim, and rush in to take any back benefits you recover.

Remember, you may or may not actually owe these back benefits. Regardless of whether you owe it or not, this situation forms an obvious conflict of interest between you and the insurer’s recommended representative.

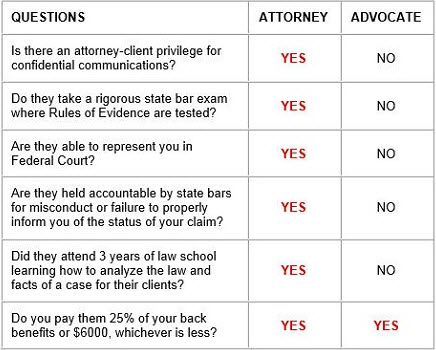

In most cases, representatives or advocates who get referrals from LTD providers are not attorneys, meaning

- you will not be protected by attorney-client privilege, and

- the representatives are not held to same level of ethical standards as attorneys.

That is the motivation for the LTD insurance company to persuade you to use their chosen SSD representative. These reps are working for the insurance company, not you. Their business is to facilitate the insurance company’s collection of overpayment.

The truth is, you are obligated to repay all back benefits to the insurance company anyway. Nothing is gained on your behalf, and money may be lost because you are not in control of what amount of back benefits are truly owed to the insurance company.

h3 id=”h-attorney-client-privilege”>Attorney-Client Privilege

Suppose the SSA denies your claim. The insurer then can use the non-attorney advocate’s disclosure that your SSD claim is denied as fuel for denying or terminating LTD benefits. Another conflict of interest.

LTD insurance carriers collaborate with non-attorney “advocates” or “representatives” because attorney-client privilege does not exist between you and the advocate. The advocate can tell everything they know about your case to the LTD carrier.

Conversely, a qualified, independent Social Security Disability attorney is bound by law to serve and protect your best interests 100% of the time. They will do all they can to ensure your claim is properly developed, that you are adequately prepared for hearings, and that your interests are protected.

h3 id=”h-a-non-attorney-advocate-cannot-represent-you-in-federal-court”>A Non-attorney Advocate Cannot Represent You in Federal Court

If your SSDI claim is denied during the administrative appeal, your last remaining remedy is to appeal your case to the federal courts. Non-lawyer representatives cannot argue denied SSDI claims to federal court on appeal. Their capabilities stop with answering questions concerning administrative policies and procedures.

Only an attorney can provide advice on the law. Even so, many general lawyers who do not specialize in Social Security Disability law are neither prepared nor willing to appeal Social Security disability claims to federal court. Aside from the skill and knowledge base, disability lawyers are prepared for the significant demand on time and resources.

h3 id=”h-attorney-accountability”>Attorney Accountability

Attorneys are bound by the ethical rules of the legal profession and are subject to the discipline of the courts and bar authorities. The rules of professional conduct obligate lawyers to ardently and competently represent their clients, charge only reasonable out-of-pocket costs, and maintain good communication with the client to keep them informed on the status of claim. A lawyer is never allowed to represent a client if the representation involves a concurrent conflict of interest.

If a lawyer were to mishandle your case or violate any rules of professional conduct, you can file a grievance with their state bar. Non-attorney advocates or representatives are not members of, nor regulated by, state bars and are not subject to the same disciplinary measures as attorneys.

Chapter 12: Attorney Representation in a Disability Claim

Every claimant is different and every case is unique. The following are just some of the ways an experienced attorney helps claimants prepare and file a disability insurance claim:

- Complete all insurance company forms correctly and without making unintentional statements that could weaken your claim;

- Review your LTD policy and advise you on its meaning, the law and your options;

- Obtain your complete claim file from the Insurance Company according to Federal ERISA statutes;

- Obtain medical reports and opinion evidence regarding your disability;

- Review your medical records and suggest additional testing to develop and prove your case;

- Fortify your claim file with further medical evidence and data;

- Consult with qualified Vocational Experts to get opinion evidence rebutting an insurance company’s denial;

- Obtain and develop evidence regarding your “Residual Functional Capacity” that is the key to your disability claim;

- Develop evidence to refute surveillance video;

- Develop evidence to refute the credibility of the insurance company’s doctors and vocational experts;

- Quickly and effectively file your administrative appeal when necessary;

- Correctly calculate your benefits;

- File a legal brief arguing the legal, medical and vocational issues in your case;

- File a lawsuit in Federal Court if necessary;

- Conduct discovery in the Federal Court case such as filing interrogatories and requests for production, as needed, as well as taking all necessary depositions;

- Respond to Motions for Summary Judgment and trying your lawsuit;

- Let the insurance company know that they cannot run over you.

If Your Claim Is Denied: